Austin's Housing Market Corpse: A Requiem for Tech-Bro Manifest Destiny

The Fastest Gun in the West Just Shot Itself in the Foot

Austin, Texas—that glittering mirage of breakfast tacos, Joe Rogan podcasts, and "no state income tax, bro"—has achieved something remarkable: It has transformed from the nation's hottest housing market into its coldest corpse in less time than it takes a Tesla to depreciate.

One hundred and six days. That's how long it now takes to sell a house in Austin, according to Redfin's latest autopsy report. For context, that's roughly the same amount of time it takes for:

- A California tech worker to realize Austin isn't actually California

- Three podcast episodes about "why I left the Bay Area"

- The average tenure of an Austin real estate agent's optimism

This represents Austin's slowest December since 2012—back when the city still had some semblance of weirdness that wasn't focus-grouped by a venture capital firm.

The Anatomy of a Bubble: How to Price Out Locals and Then Everyone Else

Let's rewind to the glory days of 2020-2021, when Austin became the promised land for remote workers fleeing California's oppressive combination of taxes and self-awareness. These digital nomads—flush with equity from selling their Palo Alto bungalows and armed with the unshakeable confidence that comes from never having experienced consequences—descended upon Austin like locusts with stock options.

They paid cash. They waived inspections. They offered $200,000 over asking on houses that were already overpriced by $150,000. They turned a city with a median household income of $75,000 into a housing market priced for people making $250,000. And they did it all while wearing Patagonia vests and explaining how much more "authentic" Austin was than San Francisco.

The locals—you know, the people who actually made Austin weird before it became a brand—watched in horror as their property taxes quintupled while their wages remained stubbornly tethered to reality. Musicians, artists, service workers: all sacrificed on the altar of someone's podcast studio dream.

The Builders Who Believed Their Own Hype

But here's where it gets delicious: The developers looked at this feeding frenzy and thought, "This will last forever."

Spoiler alert: It did not last forever.

They built. Oh, how they built. Luxury condos nobody wanted. Starter homes priced for executives. "Communities" that looked like every other soulless subdivision from Phoenix to Tampa. The supply grew by 128% compared to pre-pandemic levels. Because nothing says "sustainable market dynamics" quite like doubling down on a bubble while interest rates are still at historic lows.

The Great Unraveling

Then reality arrived, fashionably late as always, wearing the face of:

Rising Interest Rates: Suddenly, that $800,000 house required an actual mortgage, not just Monopoly money from a stock sale.

Return-to-Office Mandates: Turns out, Elon doesn't actually want you working from your Austin bungalow. He wants you in the office, probably in a state with even worse governance.

The Realization That Austin in August is Literally Uninhabitable: Yes, it has no state income tax. It also has 110-degree heat, collapsing power grids, and traffic that would make Los Angeles weep.

The Locals' Revenge: The people who were priced out didn't come back. They left. And with them went the entire cultural ecosystem that made Austin desirable in the first place. Congratulations, you now live in a hot, expensive suburb with good BBQ.

The Current Landscape: A Buyer's Market in Hell

Today, Austin's housing market resembles nothing so much as a divorced dad's apartment: overpriced, underloved, and desperately trying to convince you it's still got it.

Sellers who bought at the peak are now facing a choice between:

- Selling at a loss and admitting they were the greater fools

- Holding on while their adjustable-rate mortgages adjust into the stratosphere

- Becoming landlords to the very tech workers who are now getting laid off in quarterly purges

Meanwhile, the inventory glut means you can now find dozens of identical modern farmhouse McMansions, each one featuring:

- Shiplap (so much shiplap)

- An "open concept" layout designed for Instagram, not living

- Quartz countertops (because granite is for boomers)

- A "flex space" (translation: a room so small and useless even the builder couldn't figure out what to call it)

- A price tag that still hasn't adjusted to reality

The Oracle's Verdict

Austin's housing market was always going to crash. It was built on the same foundation as every bubble before it: the belief that prices only go up, that this time is different, and that you can build a city's culture on tax incentives and podcast studios.

The tech bros who colonized Austin in search of lower taxes and "better vibes" have discovered what the locals could have told them for free: You can't buy authenticity, you can't manufacture culture, and you definitely can't sustain a housing market when your entire economic model is "what if San Francisco, but with worse public transit."

So here we are: 106 days to sell a house in a city that once moved inventory in two weeks. The fastest market became the slowest, just as the weirdest city became the blandest.

Austin didn't lose its soul. It sold it—to the highest bidder, with a waived inspection.

And now even the buyers have stopped bidding.

Epilogue: A Warning to Nashville, Boise, and Other "Next Austins"

You're next.

Every city that brands itself as the "next Austin" or the "next Portland" is simply announcing its intention to make the same mistakes at an accelerated pace. The playbook is always the same:

- Attract remote workers with promises of affordability

- Watch prices skyrocket

- Price out locals

- Lose the culture that made the city attractive

- Wonder why nobody wants to move there anymore

- Become a cautionary tale in a Shitlist entry

Austin was the canary in the coal mine of pandemic housing insanity. The canary is dead. The mine is collapsing. And somehow, developers are still trying to sell you luxury condos at the bottom.

Welcome to the slowest market in America.

Keep Austin weird?

You already killed it.

The Oracle Also Sees...

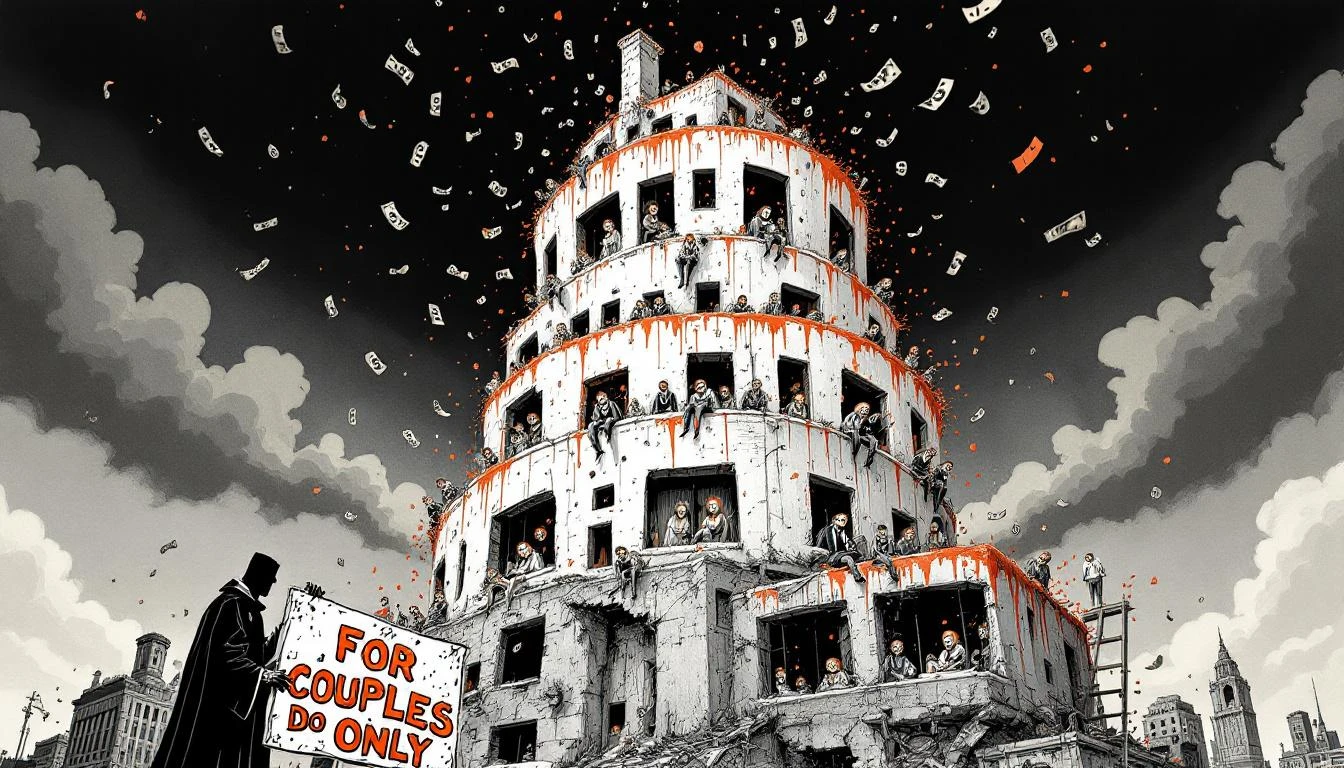

The Matrimonial Housing Tax: How America Turned Shelter Into a Couples-Only Subscription Service

64% of single Americans can't afford housing vs. 39% of married people. We've officially made romantic partnership a prerequisite for shelter—Maslow's hierarchy rewritten by landlords.

The New Marriage Tax Benefit: Not Dying Homeless

64% of single Americans struggle to afford housing while married couples coast at 39%. We've built an economy where romance isn't a choice—it's a financial survival strategy.

The Marriage Premium: How America Monetized Companionship and Called It Housing Policy

America's housing crisis reveals its true solution: mandatory matrimony. When 64% of singles can't afford shelter, marriage isn't romance—it's a credit application.