The Marriage Premium: How America Monetized Companionship and Called It Housing Policy

Love in the Time of Unaffordable Mortgages

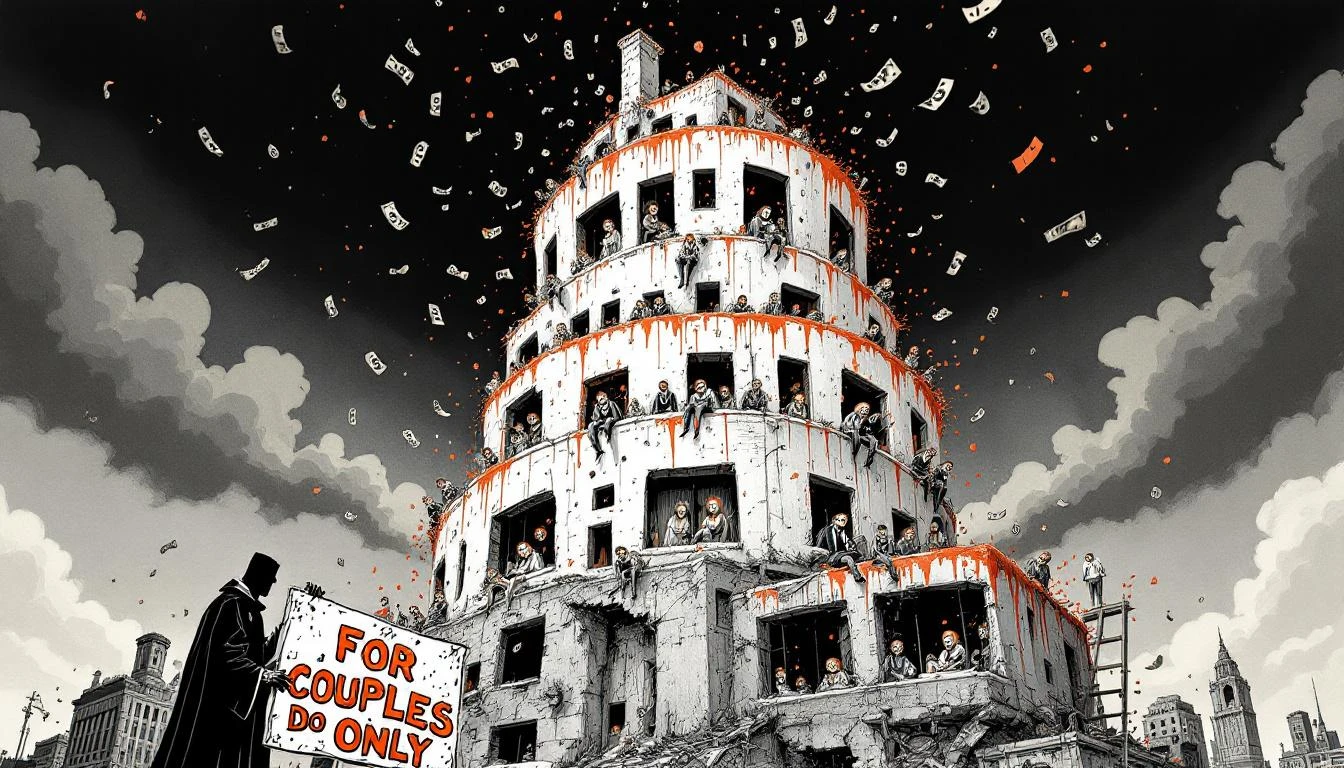

Sixty-four percent of single Americans struggle to afford housing, compared with 39% of married people. Let that marinate in your brain for a moment. The American Dream has been reclassified as a couples package — batteries not included, assembly required, dual income mandatory.

We've reached the terminal stage of late capitalism where the federal government's de facto housing policy is apparently "Have you tried getting hitched, you selfish bastard?"

The New Social Contract: Wed or Be Homeless

This isn't a housing crisis. It's a systems failure so comprehensive it would make the designers of the Hindenburg blush. We've constructed an economic architecture where basic shelter — the thing cavemen figured out before inventing the wheel — requires contractual romantic commitment.

Think about what we're actually saying here: In the wealthiest nation in human history, we've engineered a society where nearly 70% of divorced people struggle to afford housing. We've created an economic penalty for leaving bad marriages that would make a medieval pope proud. "Till death do us part" isn't romantic anymore — it's a credit score calculation.

The data is grimly poetic: 63% of single survey respondents and 69% of divorced respondents earn under $50,000 annually, compared to 26% of married respondents. Translation: We've built a housing market that requires two incomes to access one roof. It's not a market anymore — it's a ransom note.

The Dual-Income Trap, Rebranded

Remember when conservatives waxed nostalgic about single-income households? When one factory wage could buy a house, a car, and a yearly vacation? Those same politicians now preside over an economy where two professional incomes can't reliably afford a median-priced home.

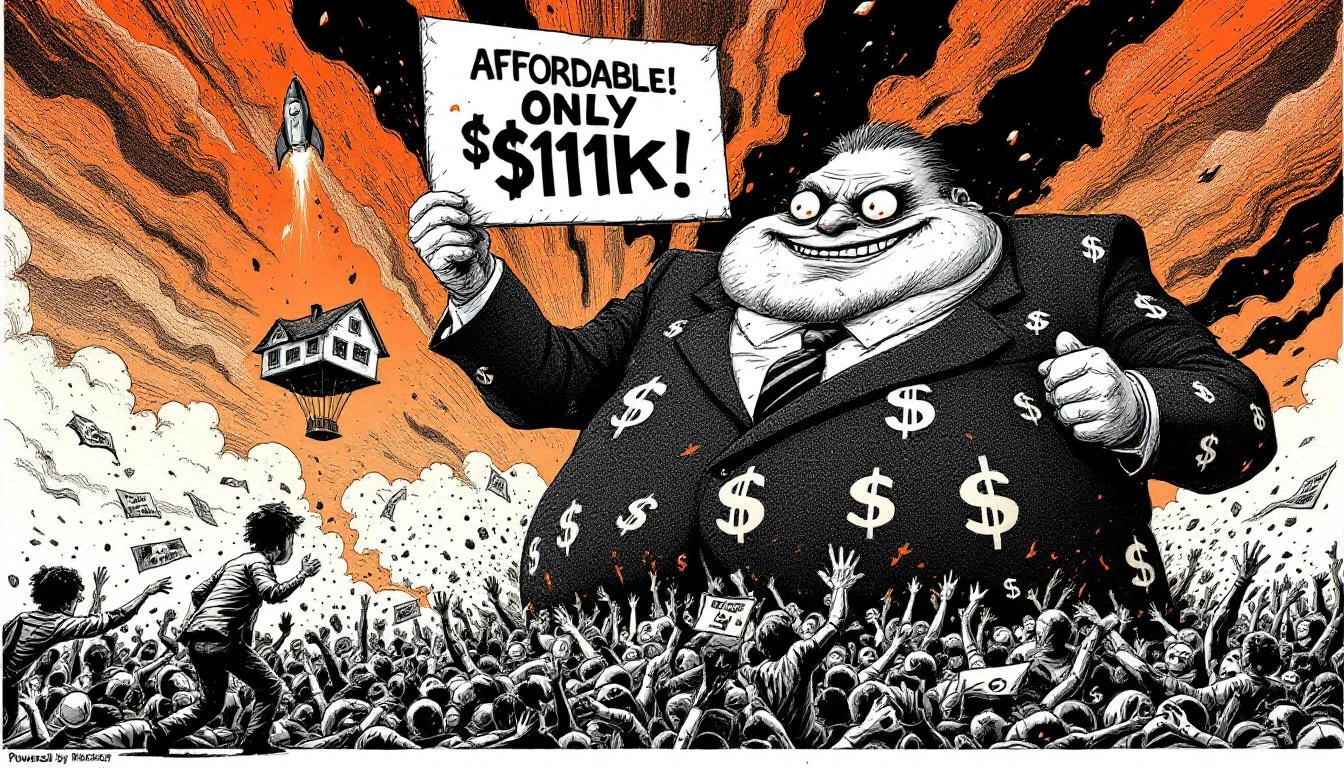

Seventy-five percent of U.S. households cannot afford a median-priced new home in 2025. Let me repeat that for the people in the cheap seats who still think this is about avocado toast: Three-quarters of American households are priced out of homeownership at the median.

We're not building a society. We're running a protection racket where the protection is "a place to sleep" and the fee is "your entire financial existence, preferably pooled with another person's entire financial existence."

The Romantic Comedy No One Asked For

Picture the Redfin-sponsored rom-com: "She was $2,400 short on rent. He had a decent credit score. Together, they could almost afford a one-bedroom in a tertiary market. Coming this Valentine's Day: 'I Do (Want to Split the Mortgage)'."

The survey of 1,800 Americans reveals what we've known but refused to admit: Marriage has become a housing subsidy. We've turned the most intimate human relationship into a financial survival strategy, then wondered why divorce rates climb and marriage rates plummet.

Young people aren't avoiding marriage because they're commitment-phobic or obsessed with freedom. They're avoiding it because they've watched their parents' generation turn matrimony into a mandatory economic bundle — like cable companies forcing you to buy 900 channels when you just want HBO.

And here's the sick joke: Even married couples are drowning. That 39% struggling to afford housing? That's with combined incomes. That's with the supposed advantage. Imagine being told "two incomes are better than one" and still nearly half of you can't make the numbers work.

The Great Resegregation

This isn't just about singles versus marrieds. It's about the systematic reconstruction of class barriers using housing as the weapon of choice. The divorced pay a penalty. The widowed pay a penalty. The perpetually single pay a penalty. Anyone who doesn't fit the dual-income household model gets economically kneecapped.

We're witnessing the financialization of human relationships in real-time. Date for love? Sure, if you can afford to. But if you want shelter, you'd better start swiping with an eye toward W-2s and debt-to-income ratios.

The real estate industry, with its typical flair for dystopian cheerleading, presents this data as market analysis rather than social catastrophe. "Single people have a harder time," they report, as if describing weather patterns rather than an economic system that punishes half the adult population for not coupling up fast enough.

The Unspoken Policy

Here's what nobody in power will admit: This is working exactly as designed. Expensive housing keeps workers compliant. Can't afford to leave your job when you're chained to a mortgage that requires every dollar you earn. Can't risk entrepreneurship when missing two paychecks means homelessness. Can't leave that toxic relationship when going back to single life means going back to sleeping on a friend's couch.

The system doesn't have a housing affordability problem. The system is the housing affordability problem. Every politician who stands up and promises to "address the crisis" while protecting property values, restricting construction, and celebrating mortgage-backed securities is selling you a lie wrapped in a press release.

The Prophet's Conclusion

We've created a civilization where the answer to "How can I afford shelter?" is increasingly "Find another person and pool your poverty." This is the endgame of treating housing as investment vehicles rather than human necessity.

The Redfin report doesn't reveal a housing crisis. It reveals a social extinction event — the slow-motion elimination of independent adult existence. Single-income households aren't economically viable anymore. Single people aren't economically viable anymore. The American experiment has been reduced to a co-signing requirement.

And the cruelest part? They'll never call it what it is. They'll publish surveys. They'll write think pieces. They'll suggest budgeting tips and side hustles. But they won't say the quiet part out loud: We've designed a society where being alone is a luxury only the wealthy can afford.

Sixty-four percent of single Americans struggle to afford housing. The other 36% are either lying, inheriting, or about to join the majority.

Welcome to the future, where the price of a roof over your head is your romantic autonomy.

The Oracle has spoken. The charts don't lie, but the people interpreting them sure as hell do.

The Oracle Also Sees...

The Matrimonial Housing Tax: How America Turned Shelter Into a Couples-Only Subscription Service

64% of single Americans can't afford housing vs. 39% of married people. We've officially made romantic partnership a prerequisite for shelter—Maslow's hierarchy rewritten by landlords.

The New Marriage Tax Benefit: Not Dying Homeless

64% of single Americans struggle to afford housing while married couples coast at 39%. We've built an economy where romance isn't a choice—it's a financial survival strategy.

The Ministry of Truth Announces Victory: You Only Need $111,000 to Afford Shelter Now

Redfin celebrates "improving affordability" because homes now require only $111,000 salary—just 29% more than median income. This is economic gaslighting as performance art.