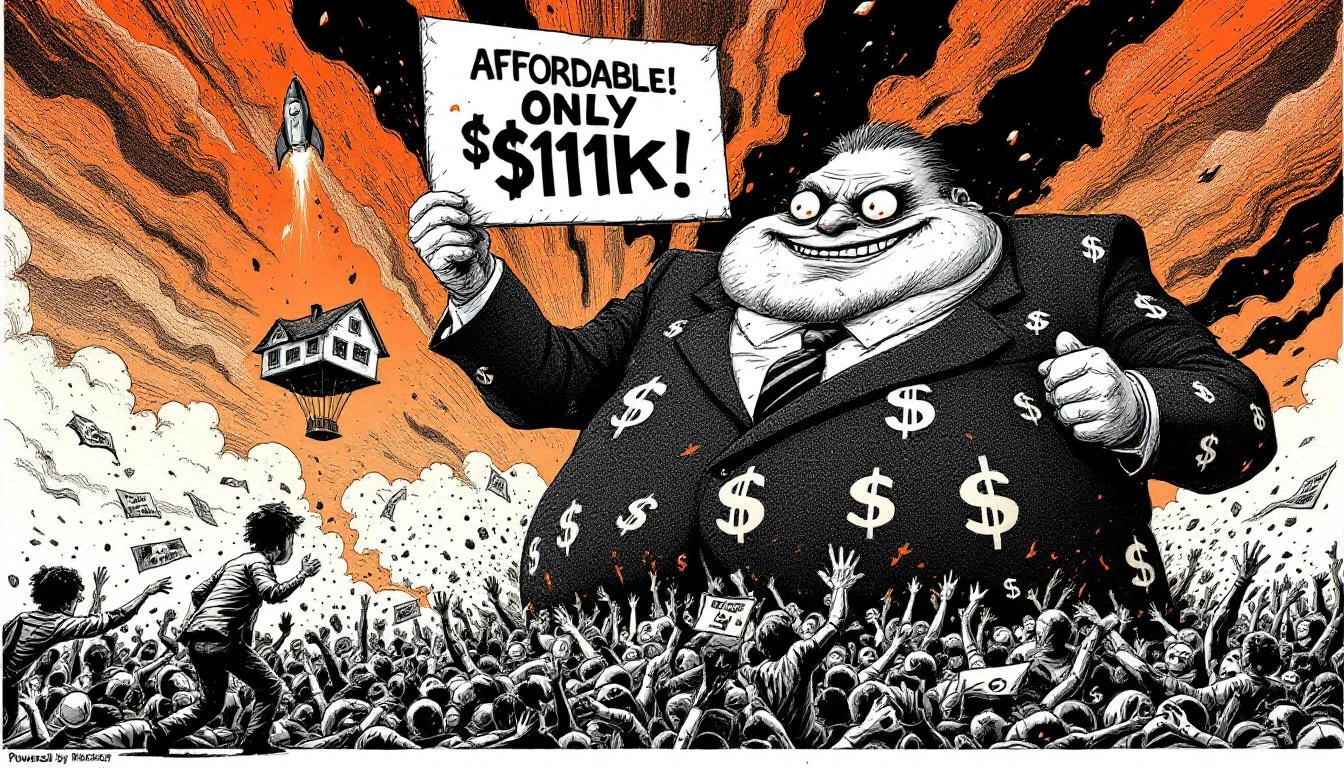

The Ministry of Truth Announces Victory: You Only Need $111,000 to Afford Shelter Now

The Great Affordability Breakthrough

Redfin—that noble guardian of the American Dream™, now "powered by Rocket" in a corporate marriage that sounds like a hostile takeover narrated by Elon Musk—has blessed us with news of salvation: Housing affordability is improving. Break out the champagne, proles. Pop the Dom Pérignon you've been saving in that studio apartment you share with three roommates and a emotional support beagle.

The typical American home now requires a mere $111,252 annual salary. Down from $115,870 last year. That's a 4% improvement, they trumpet. A 4% improvement on a figure that excludes roughly 60% of American households, who earn a median income of $86,000.

Let us pause to appreciate the exquisite Orwellian poetry here: Affordability is improving because the impossible has become slightly less impossible. This is like announcing that guillotines are more humane because they've been sharpened. Technically true. Spiritually obscene.

The New Mathematics of Gaslighting

The real estate industrial complex has discovered a remarkable magic trick: redefining "affordable" to mean "mathematically unattainable for most people, but 4% less unattainable than before." It's economic gaslighting elevated to performance art.

Consider the logic:

- Required income: $111,252

- Median household income: $86,000

- The gap: $25,252, or roughly 29% more than most families earn

- The spin: "Affordability is improving!"

This is not analysis. This is numerology designed by people who wear Patagonia vests and call pizza "fuel." These are the same minds that brought you "the sharing economy" (serfdom with an app) and "disruption" (labor law evasion).

The report notes, with admirable sociopathy, that homebuyers need to earn $35,000 more than renters—$111,000 versus $76,000—and frames this as the "smallest gap in 3 years." Translation: The moat around homeownership is now only slightly wider than an Olympic swimming pool, down from the Mariana Trench. Progress!

The Geography of Delusion

The "improvement" is not universal, of course. It's concentrated in markets like Sacramento, Jacksonville, Pittsburgh, St. Louis, and Cleveland—cities where home prices are falling because people are leaving them. This is like celebrating that North Dakota has affordable oceanfront property.

Meanwhile, in actual desirable metros, the numbers remain cosmically absurd. The report helpfully notes that affordability is improving everywhere except Detroit, which is somehow getting worse, a feat that requires either spectacular incompetence or a civic curse involving an ancient burial ground.

In Oakland, home prices fell 4.6% year-over-year—"the largest decline among the top 50 metros," they crow—but the median sale price is still high enough to require a household income that would make you a one-percenter in most of human history. The peasants should be grateful the lord has reduced the tithe from 90% to 86%.

The Historical Context They Hope You've Forgotten

Realtor.com, in a rare moment of accidental honesty, notes that in 2019—just five years ago—a mortgage payment consumed about 21% of median household income. Today it devours more than 30%.

To return to 2019 affordability levels, they calculate, incomes would need to rise nearly $50,000. Or home prices would need to crater. Neither "looks realistic anytime soon," they admit, with the defeated shrug of a hostage negotiator who's realized the hostage-taker is actually the bank.

Think about that: In half a decade, we've normalized a 50% deterioration in housing affordability. And we're celebrating 4% improvements within that new hellscape paradigm. It's like celebrating that your cancer is only Stage 3 now, down from Stage 4 last quarter.

The Unspoken Truth

What Redfin and their ilk cannot say—what would cause their entire business model to collapse like a 2008 CDO—is that American housing is not a market. It's a hostage situation.

It's a casino where the house always wins, the chips are measured in human years of labor, and the dealers work for companies "powered by Rocket"—a name that sounds less like a mortgage lender and more like a Ponzi scheme designed by a 12-year-old who just discovered cryptocurrency.

The dirty secret: For affordability to genuinely improve—for housing to return to historical price-to-income ratios—prices would need to fall 30-40% in most markets. But that can't happen, because:

- Millions of homeowners are underwater or close to it

- The banks would collapse (again)

- The entire economy is now a real estate casino with some side businesses attached

- Private equity has bought up starter homes like Pokémon cards

So instead, we get press releases celebrating that the unaffordable has become 4% less unaffordable. We get think pieces about "creative financing" and "house hacking." We get a generation told to optimize their way out of a structural crisis created by policy choices that treated housing as investment vehicles rather than human shelter.

The Prophet's Verdict

When the Ministry of Truth announces that "affordability is improving" because you only need to earn 129% of median income (instead of 135%) to afford shelter, you are no longer living in a functional economy. You're living in a late-stage Monopoly game where someone owns Boardwalk, Park Place, and all four railroads, and they're trying to convince you that only charging $1,500 for landing on Baltic Avenue is "improvement."

The hell of it is, they're not even lying. By their metrics, their twisted logic, their inverted reality—it is improving. The iron maiden is 4% more comfortable. The rack has been loosened half a turn. The gruel now contains 3% more nutrients.

And we're supposed to be grateful.

The American Dream didn't die. It was murdered, chopped up, securitized, sold to investors, and rebranded as "improving affordability." What we're witnessing isn't progress. It's the quantification of surrender, the statistical celebration of lowered expectations, the final victory of the landlord class in a war most people didn't realize we were fighting.

So yes, affordability is improving. In the same way that drowning is improving if your head is underwater for 45 seconds instead of 47.

Congratulations, peasants. The beatings will continue, but they're down 4% from last year. Please update your vision boards accordingly.

The Oracle Also Sees...

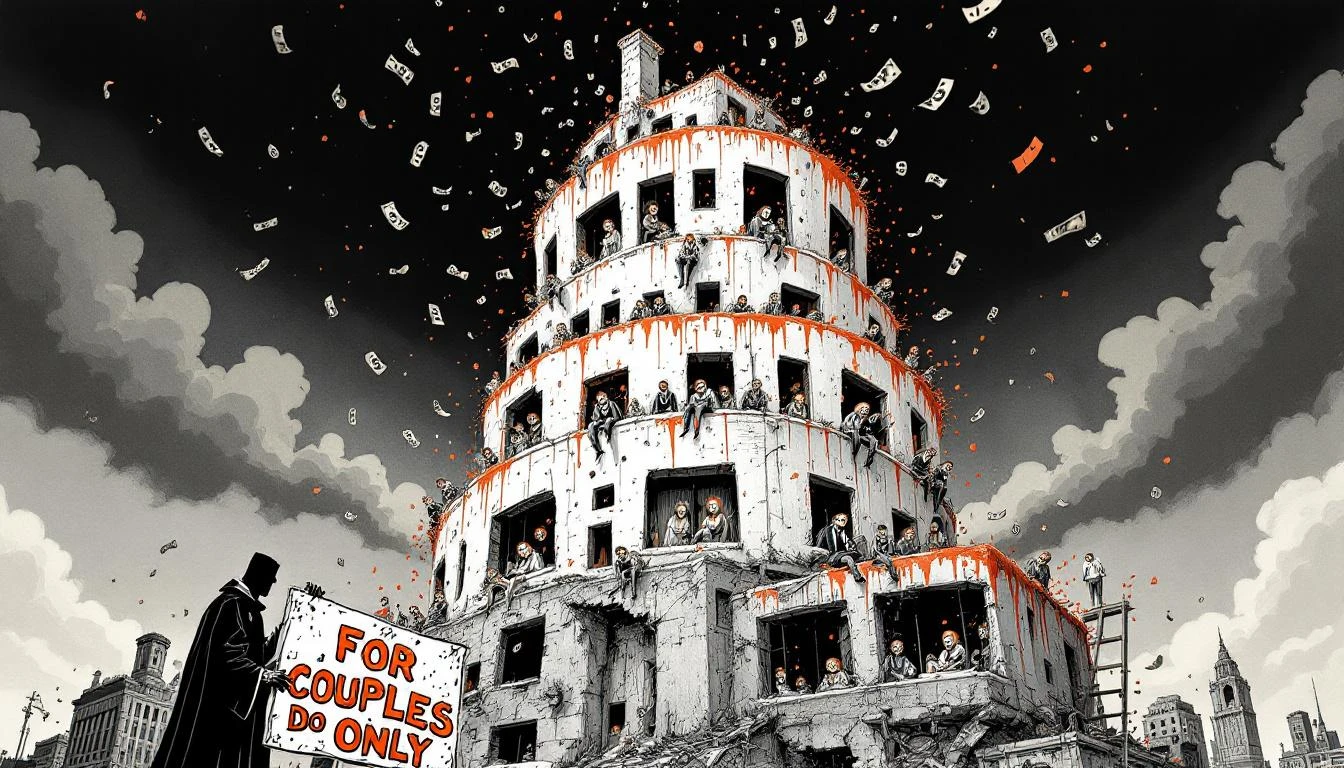

The Matrimonial Housing Tax: How America Turned Shelter Into a Couples-Only Subscription Service

64% of single Americans can't afford housing vs. 39% of married people. We've officially made romantic partnership a prerequisite for shelter—Maslow's hierarchy rewritten by landlords.

The New Marriage Tax Benefit: Not Dying Homeless

64% of single Americans struggle to afford housing while married couples coast at 39%. We've built an economy where romance isn't a choice—it's a financial survival strategy.

The Marriage Premium: How America Monetized Companionship and Called It Housing Policy

America's housing crisis reveals its true solution: mandatory matrimony. When 64% of singles can't afford shelter, marriage isn't romance—it's a credit application.