Bread, Circuses, and the Mortgage You'll Never Have: A Super Bowl Autopsy

The Empire Declines in $13,000 Increments

Let us begin with a simple arithmetic problem that would make Nero weep with envy: Seattle and Boston football enthusiasts are preparing to spend the equivalent of three monthly mortgage payments—roughly $12,681 to $13,031 per couple—to watch grown men give each other brain damage for sixty minutes of actual gameplay.

For renters in these cities, the calculation grows even more biblical: Seattle tenants will hemorrhage nearly six months' rent. Boston renters, a comparatively thrifty four months.

This is not a story about sports. This is a story about a civilization that has forgotten how to do basic fucking math.

The Housing Math They Won't Do

Here's what that $13,000 Super Bowl pilgrimage actually represents in the cold light of financial reality:

- Down payment potential: 20% on a $65,000 property (good luck finding one)

- Emergency fund: Six months of expenses for the average American household

- Principal reduction: A year's worth of aggressive mortgage overpayments

- Retirement contribution: Maximum annual Roth IRA contribution with $6,500 to spare

But sure, let's watch beer commercials on a jumbotron while sitting in $800 nosebleed seats because Tom from accounting said it's a "once-in-a-lifetime experience."

Newsflash: Your team has a 50% chance of losing. Your housing market has a 100% chance of continuing to fuck you.

The Cognitive Dissonance Olympics

The same people dropping $13K on a football game are the ones breathlessly sharing articles about how "Millennials Can't Afford Houses Because of Avocado Toast."

The same cities—Seattle and Boston—where the median home price hovers around $700,000 to $900,000, where starter homes are mythical creatures, where "affordable housing" means a 600-square-foot condo forty-five minutes from civilization—these are the markets hemorrhaging thousands of dollars per capita on a single sporting event.

Redfin, bless their data-driven hearts, has done us the service of holding up a mirror to our national psychosis. The numbers don't lie, but the people sure as hell do—mostly to themselves.

The Housing Crisis as Lifestyle Choice

Here's the uncomfortable truth that real estate agents won't tell you during open houses: The housing crisis is partially self-inflicted by a culture that has elevated consumption over accumulation.

We live in an era where:

- 63% of Americans can't afford a $500 emergency expense

- The average household carries $6,000+ in credit card debt

- Housing affordability is at a 40-year low

- Consumer spending on "experiences" has never been higher

The Super Bowl is merely the most American expression of this pathology—a perfect storm of conspicuous consumption, tribal identity theater, and financial suicide packaged as "making memories."

Memories don't appreciate in value. Real estate does. Choose wisely.

The Ticket Stub You Can't Refinance

Let's game this out for the true believers:

Scenario A: You go to the Super Bowl

- Spend: $13,000

- Get: Hangover, Instagram content, potential frostbite

- Five-year value: $0

- Dinner party bragging rights: 18-24 months

Scenario B: You put that money toward housing

- Spend: $13,000

- Get: Down payment seed money, emergency fund, mortgage principal reduction

- Five-year value: Potentially $20,000+ (assuming 8% annual home appreciation)

- Dinner party bragging rights: Indefinite (homeownership is the ultimate flex)

The math is so obvious it hurts. Which is precisely why most people refuse to do it.

The Redfin Report as Modern Scripture

Redfin's analysis is less a real estate report and more an anthropological field study of American decline. When a real estate company has to explain to its customer base that a football game costs more than a quarter-year of housing, we've crossed into post-rational territory.

This is the same market where:

- Seattle's median mortgage payment is $4,316/month

- Boston's is $4,191/month

- Both cities have homeownership rates below the national average

- Both cities have renter populations screaming about affordability

And yet tens of thousands will make the pilgrimage, will max out credit cards, will drain savings accounts, will sacrifice fiscal prudence at the altar of live sports.

Hunter Thompson once said, "The NFL is a monument to despair." He was talking about the sport. He hadn't seen the ticket prices.

The Uncomfortable Questions

If you're reading this and feeling defensive, good. Sit with that discomfort. Then ask yourself:

- How many Super Bowl trips until you've spent a full year of rent?

- How many "once-in-a-lifetime experiences" can one lifetime afford?

- What does it say about your priorities when you'll drop $13K on a game but won't offer $12K over asking on a house?

- Why is "treating yourself" always consumption, never investment?

The housing crisis is real. Interest rates are punishing. Inventory is constrained. But let's not pretend that cultural spending patterns aren't part of the equation.

You cannot simultaneously complain about housing affordability and drop five figures on sporting events. Well, you can, but you're a fucking hypocrite.

The Oracle's Decree

The Super Bowl is not an investment. It's a tax on financial illiteracy disguised as fandom.

Every dollar spent on this spectacle is a dollar that could've gone toward actual wealth building. Every ticket purchased is a vote for entertainment over equity. Every Instagram story from the stadium is a monument to misplaced priorities.

The housing market doesn't care about your team loyalty. It only cares about your down payment.

Seattle and Boston fans will spend over $260 million combined on this game. That's enough to fund 4,000 full down payments on median-priced homes in America. That's enough to alter the trajectory of 4,000 families' financial futures.

Instead, it'll be spent on overpriced beer, parking, and the privilege of watching millionaires play a children's game.

Postscript: The Return on Investment

When you're 55 years old and still renting, when your retirement account looks like a rounding error, when you're navigating medical bankruptcy because you have no financial cushion—remember this moment.

Remember when you had $13,000 and chose spectacle over security.

Remember when everyone told you housing was unaffordable, and you proved them right by spending your down payment on a football game.

The Super Bowl ends. The housing crisis doesn't.

Choose accordingly.

The Oracle Also Sees...

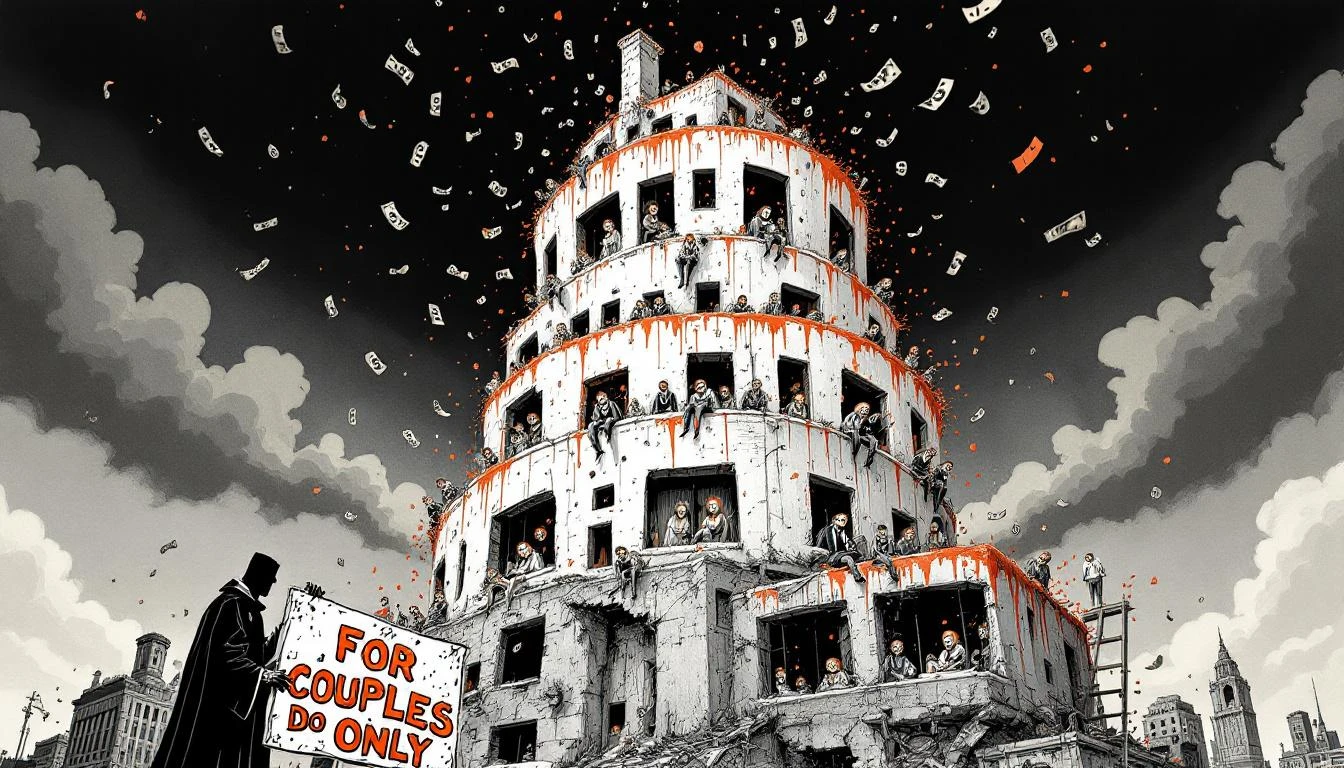

The Matrimonial Housing Tax: How America Turned Shelter Into a Couples-Only Subscription Service

64% of single Americans can't afford housing vs. 39% of married people. We've officially made romantic partnership a prerequisite for shelter—Maslow's hierarchy rewritten by landlords.

The New Marriage Tax Benefit: Not Dying Homeless

64% of single Americans struggle to afford housing while married couples coast at 39%. We've built an economy where romance isn't a choice—it's a financial survival strategy.

The Marriage Premium: How America Monetized Companionship and Called It Housing Policy

America's housing crisis reveals its true solution: mandatory matrimony. When 64% of singles can't afford shelter, marriage isn't romance—it's a credit application.