The AI Bubble: A Trillion-Dollar Hallucination with Venture Capital Characteristics

The Empire of Expensive Nonsense

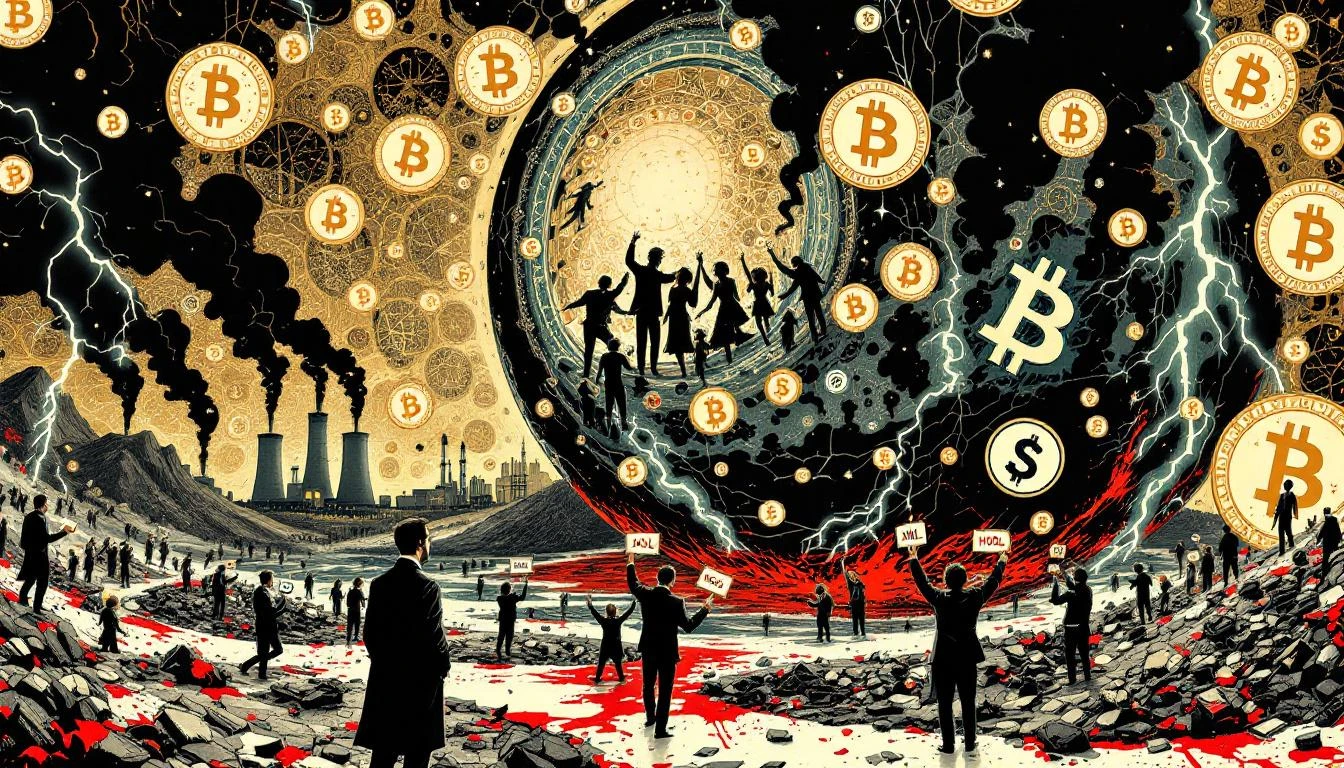

We are living through the most spectacular act of financial self-delusion since Dutch merchants convinced themselves that tulip bulbs were worth more than houses. Except this time, the tulips can plagiarize your term papers and occasionally inform you, with complete confidence, that Napoleon won the Battle of Waterloo on the surface of Mars.

The AI bubble isn't just a bubble—it's a circular firing squad with a $241 billion ammunition budget. The hyperscalers—Google, Microsoft, Amazon, Meta, and Oracle—are locked in a financial ouroboros so perfectly stupid it would make a Renaissance alchemist weep with envy. They're buying each other's chips, renting each other's cloud capacity, investing in each other's startups, and collectively hallucinating a future where chatbots that can't reliably count the letter 'r' in 'strawberry' will somehow achieve consciousness and solve climate change.

The Theology of Artificial General Intelligence

Sam Altman speaks of AGI with the fervor of a tent revival preacher, except instead of salvation he's selling computational power that requires the electrical output of a small nation to tell you that "as an AI language model" it can't have opinions while simultaneously having very strong opinions about everything. OpenAI burns through billions like a divorced hedge fund manager at a Miami nightclub, promising us paradise while delivering a $20-a-month subscription to sophisticated autocomplete.

The valuations are pure religious experience. Companies with no profits, questionable products, and business models that amount to "step one: spend billions on GPUs, step two: ???, step three: profit" are worth more than the GDP of Portugal. Your dentist has pivoted to being "AI-first." Goldman Sachs has discovered that adding "powered by AI" to any pitch deck increases valuations by 40%. We've seen this movie before—we just keep forgetting the ending.

The Great Vendor Financing Scam

Here's the beautiful part: Nvidia sells chips to Microsoft. Microsoft invests in OpenAI. OpenAI buys more Nvidia chips using Microsoft's money. Nvidia's stock goes to the moon. Everyone's balance sheet looks fantastic. It's a perpetual motion machine of capital that violates only the laws of physics, economics, and common sense.

Paul Kedrosky calls this the Minsky moment—when credit expansion exhausts all the good projects and starts funding the stupid ones. We're past that moment, friends. We're funding projects that make Pets.com look like Standard Oil. We're giving billions to companies whose primary innovation is making chatbots sound slightly less like they're having a stroke.

The Chinese Mirror

Then DeepSeek arrives from China—a model that costs 1/50th what OpenAI spent and performs almost as well. The market convulsed. Nvidia lost $600 billion in market cap faster than you can say "competitive moat." Jensen Huang, to his credit, called it "a gift to the world's AI industry," which is CEO-speak for "oh fuck, the jig might be up."

The revelation isn't that Chinese engineers are brilliant—it's that the American AI emperors have been spending like drunken sailors on shore leave while wearing very expensive clothes that may not actually exist. Turns out you don't need to boil the ocean to make a decent chatbot. Who knew? (Everyone who wasn't getting paid to not know.)

The Dot-Com Rhyme

Ray Dalio—who actually predicted the 2008 collapse while everyone else was snorting lines off mortgage-backed securities—sees the pattern. So does Baidu's CEO. The S&P 500 doubled before March 2000, then spent two years cutting that gain in half. We're watching the same dance with different music.

The AI Index looks exactly like every bubble chart ever drawn: a hockey stick of hype and capital allocation that would make John Law's Mississippi Company blush. When seven stocks account for basically all market gains and all of them are betting on the same unproven technology, you don't have a diversified market—you have a suicide pact with great PR.

The Open Source Escape Hatch

The only genuinely interesting development is that open-source AI has created $8.8 trillion in value over two decades by not being a grift. By sharing rather than hoarding. By building rather than financializing. The irony is so thick you could pour it over pancakes: the path forward exists, it's proven, and it's completely orthogonal to everything Wall Street is doing.

But that requires actual work instead of PowerPoint decks about AGI. It requires building useful tools instead of promising artificial gods. It requires engineering instead of theology.

The Reckoning

When this bubble pops—and it will pop, they always pop—it won't be because AI isn't useful. It'll be because we valued it like it was magic instead of software. Because we let CEOs become prophets and quarterly earnings become scripture. Because we forgot that compound interest and compound delusion both eventually settle their accounts.

The 2008 crisis happened because nobody believed housing prices could fall and all the banks were holding each other's toxic paper. The AI crisis is pre-loading itself with the exact same dependencies: circular investments, vendor financing, and a collective agreement not to ask what happens if the technology doesn't deliver gods but merely delivers... tools.

Useful tools, perhaps. Transformative tools, maybe. But tools nonetheless, not deities. And you don't value a hammer at ten times the GDP of France.

The Oracle's Verdict

The AI bubble is peak American capitalism: Take something genuinely interesting, financialize it into absurdity, let everyone's dentist invest in it, ignore all historical precedent, and act shocked when mathematics reasserts itself.

We've built a trillion-dollar temple to the god of autocomplete and we're surprised when the god keeps hallucinating. The prophecy is simple: This ends badly. The only question is whether we learn anything when it does.

Spoiler: We won't. We never do. There's already someone out there preparing a pitch deck for the Next Big Thing, and this time—this time!—it'll be different.

It won't be. It never is.

But the schadenfreude will be spectacular.

The Oracle Also Sees...

The Great American Ponzi Scheme Enters Its Final Act: A Meditation on Social Security's Accelerated Death Spiral

Social Security's insolvency date just jumped three years closer. The great American safety net unravels faster than predicted, while Congress perfects the art of aggressive inaction.

Coinbase Loses $667 Million, Declares Victory Because Idiots Still Gambling

Coinbase loses $667M as customers flee, but celebrates because some desperate gamblers are still throwing money into the void. Corporate delusion meets crypto winter.

The Immaculate Conception of Worthlessness: How Crypto Bros Accidentally Reinvented Every Financial Disaster They Claimed to Fix

How libertarian coders accidentally recreated every financial disaster in history while burning Argentina's worth of electricity to mint worthless tokens and pretending they'd revolutionized money.