The Great American Ponzi Scheme Enters Its Final Act: A Meditation on Social Security's Accelerated Death Spiral

The Check Is in the Mail (But the Mail Is on Fire)

Six years. Six years. The great intergenerational contract that kept Grandma from eating cat food and gave millions of Americans the quaint notion that their government might occasionally do something useful is now circling the drain faster than a Congressional ethics investigation.

The Social Security trust fund—that magnificent fiction we've all agreed to believe in, like Santa Claus or trickle-down economics—is now projected to hit empty in 2031. Not 2034, as the soothsayers predicted just last year. Not even 2033, which was already uncomfortably close to the present tense. No, the actuaries have sharpened their pencils and discovered what any moderately attentive chimpanzee could have told you: when you systematically ignore a problem for forty years while making it worse, the problem doesn't improve.

The Sound of Cans Being Kicked

This shouldn't surprise anyone who's been conscious since Reagan was president. The demographic time bomb has been ticking since Baby Boomers first discovered sex, drugs, and the profound selfishness of having fewer children than their parents while expecting even more retirement benefits. Politicians of both parties have known about this impending catastrophe for decades—the Greenspan Commission warned us in 1983, for Christ's sake—and their response has been a masterclass in cowardice, consisting primarily of theatrical hand-wringing followed by aggressive inaction.

The Republican position has been admirably consistent: pretend the problem doesn't exist, then propose "solutions" that amount to dismantling the program entirely while calling it "privatization" or "personal accounts" or some other Orwellian euphemism. The Democratic response has been equally predictable: acknowledge the problem exists, promise to fix it by making rich people pay their fair share, then do absolutely nothing while sending fundraising emails about how the Republicans want to kill Social Security.

Both are correct. Both are lying. The cognitive dissonance is exquisite.

The Mathematics of Delusion

Here's what the optimists won't tell you: even if Congress removed the cap on Social Security taxes tomorrow—making millionaires and billionaires pay the same percentage as the schlubs earning $50,000—we'd still hit reserve depletion before most Gen Xers make it to retirement. The Roosevelt Institute, those wild-eyed radicals, crunched the numbers and discovered that even their preferred solution only kicks the can to 2063. Which means we'd need to kick it again in forty years, assuming civilization hasn't collapsed by then.

The 2025 Trustees Report—a document written in the bureaucratic equivalent of a whisper so nobody would notice—projects that come 2031, Social Security will only be able to pay 79% of scheduled benefits. Translation: your monthly check will arrive 21% lighter, like a pizza where someone ate a quarter of it before delivery. Except you already paid for the whole pizza. Forty years ago. With interest.

For the 75 million Americans currently receiving benefits, this means poverty. For the hundred million more counting on it, this means Excel spreadsheets full of increasingly desperate retirement scenarios. For politicians, this means... well, nothing really changes for them. They have different pensions.

The Accelerating Collapse

What makes this latest projection particularly delicious is the acceleration. The insolvency date has moved up three years in just the last twelve months. At this rate, by 2027 we'll discover Social Security actually went bankrupt in 2019 and nobody noticed. The actuaries keep "discovering" that their previous projections were too optimistic, like a gambler who keeps recalculating when he'll break even.

The reasons are grimly predictable: lower birth rates, longer lifespans, wage stagnation, and the inexorable mathematics of a pay-as-you-go system in a country that stopped going. We started drawing down reserves around 2009—much earlier than projected—because reality has this annoying habit of not conforming to government spreadsheets.

The "Solutions" (A Comedy in Multiple Acts)

The establishment would like you to know there are many options for fixing this. The Trustees Report cheerfully notes that "lawmakers have many options for changes" and should act "sooner rather than later," which is government-speak for "we're fucked and everybody knows it but nobody wants to be the one to say it."

These options include:

Raising the retirement age (because coal miners and construction workers should definitely work until 70)

Cutting benefits (see above re: cat food)

Raising taxes (political suicide in a country where 'tax' is a four-letter word)

Means testing (turning a universal program into welfare, which Americans can then comfortably destroy)

"Comprehensive reform" (doing nothing while forming committees)

The exquisite irony is that the longer Congress waits, the more draconian the eventual solution becomes. Every year of inaction makes the math worse. But taking action requires political courage, which is the one natural resource America has completely depleted.

The Wrong Question

Economists—those priesthood of the obvious—now insist that asking "will Social Security run out?" is the wrong question. The correct question, apparently, is "how much will benefits be cut?" This is like asking whether you'd prefer to be shot in the leg or the stomach. The answer is "neither, you sociopath."

The program won't disappear entirely—payroll taxes will still fund about 79% of benefits—but that 21% reduction will devastate millions of Americans for whom Social Security isn't a supplement but survival. Half of all Americans over 65 depend on Social Security for at least 50% of their income. For a quarter of them, it's virtually everything.

But sure, let's have another debate about whether we can afford universal healthcare.

The Generational Grift

The true genius of this slow-motion disaster is how it's been engineered to pit generations against each other. Boomers, who spent decades voting for tax cuts and unfunded wars, are now shocked—shocked—to discover there might not be enough money for their retirement. Gen X, that ignored middle child of American generations, watches with characteristic cynicism as they realize they'll pay into the system their entire lives and get precisely fuck-all in return. Millennials and Gen Z aren't even pretending Social Security will exist when they're old; they're too busy trying to afford rent.

Meanwhile, the same politicians who created this mess are busy protecting their own defined-benefit pensions, which are totally different and definitely not socialism.

The Reckoning

Six years. Not six decades. Not six election cycles. Six years until the music stops and someone has to explain to 75 million Americans why the deal is off.

The Committee for a Responsible Federal Budget—a group whose very name is an admission of failure—notes that Social Security is "racing towards insolvency" as it turns 90. What a birthday present. It's like watching someone's retirement party turn into their funeral.

Congress will eventually act, of course. Probably around 2030, when the panic becomes impossible to ignore and the solutions become maximally painful. They'll patch something together that screws everyone equally while pretending it's fair. They'll call it "reform" and "strengthening" when it's really just managed decline.

And through it all, the one constant will be the absolute certainty that this was all preventable. Every economist, every actuary, every policy wonk has been screaming about this for forty years. But prevention requires sacrifice, and sacrifice requires leadership, and leadership requires courage.

America's checking account is overdrawn. The credit cards are maxed. And the repo man is six years out.

Tick. Tock. Tick. Tock.

The oracle has spoken. The apocalypse will be means-tested.

The Oracle Also Sees...

The AI Bubble: A Trillion-Dollar Hallucination with Venture Capital Characteristics

We're watching a trillion-dollar circular firing squad where tech giants buy each other's AI chips, invest in each other's startups, and collectively hallucinate that chatbots will achieve consciousness—while China builds the same thing for 2% of the cost.

Coinbase Loses $667 Million, Declares Victory Because Idiots Still Gambling

Coinbase loses $667M as customers flee, but celebrates because some desperate gamblers are still throwing money into the void. Corporate delusion meets crypto winter.

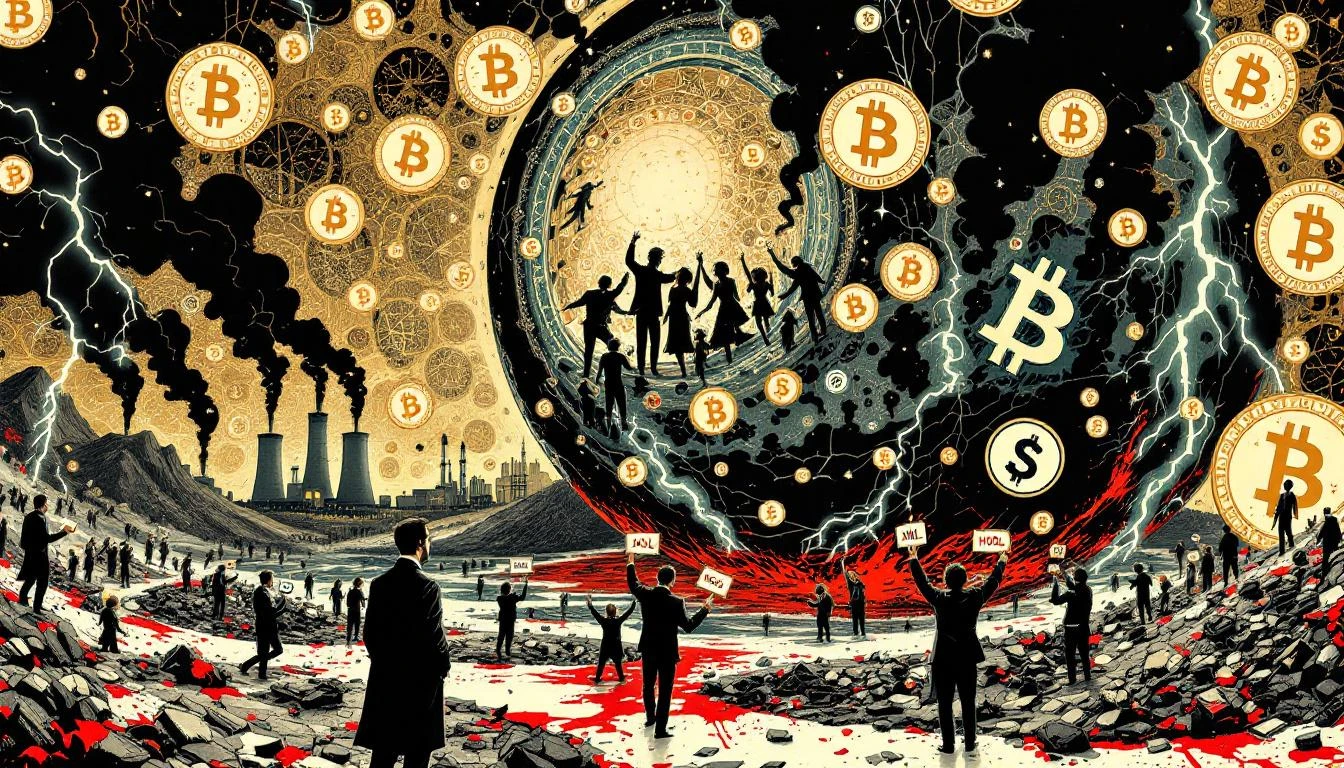

The Immaculate Conception of Worthlessness: How Crypto Bros Accidentally Reinvented Every Financial Disaster They Claimed to Fix

How libertarian coders accidentally recreated every financial disaster in history while burning Argentina's worth of electricity to mint worthless tokens and pretending they'd revolutionized money.