Coinbase Loses $667 Million, Declares Victory Because Idiots Still Gambling

The House Always Loses (When It's Built on Vapor)

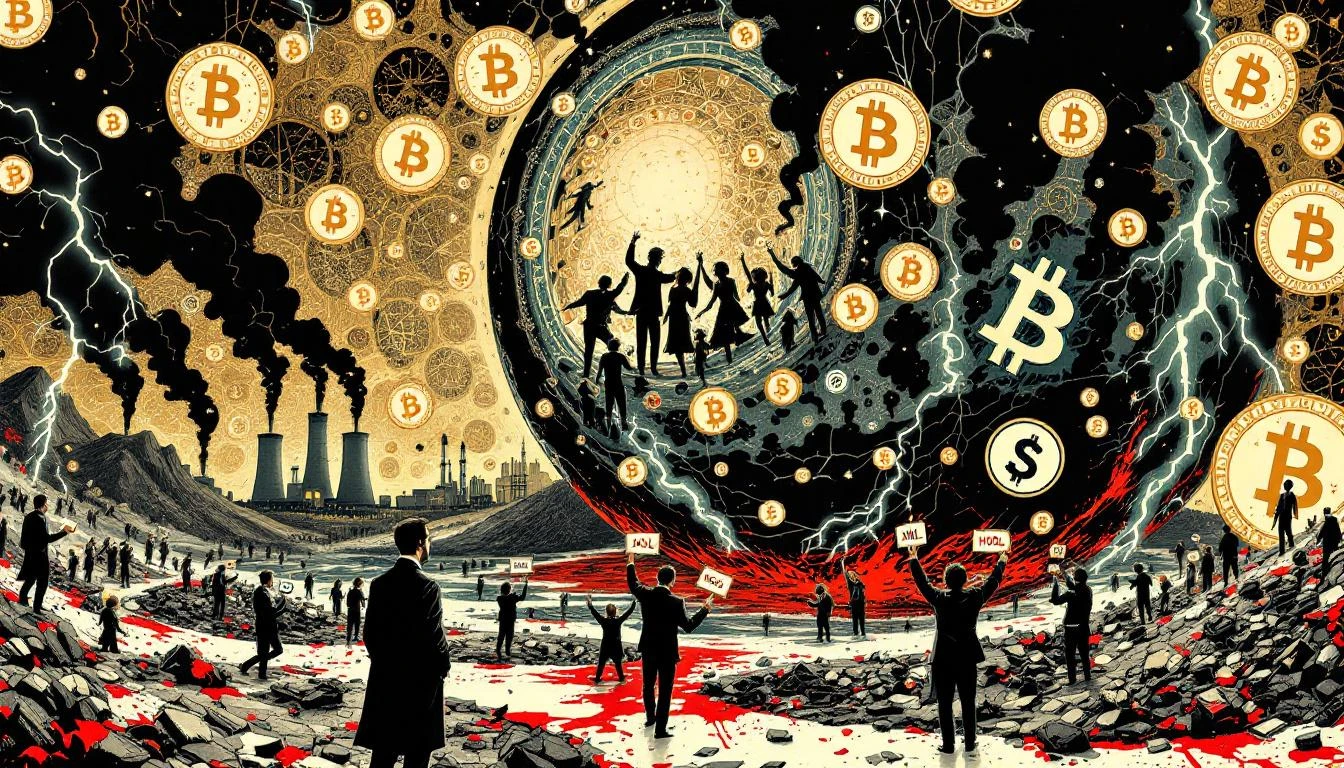

Coinbase Global Inc., the digital casino that convinced a generation of Reddit philosophers they were "investors," has managed to lose $667 million in a single quarter while simultaneously assuring shareholders that everything is fine because some people are still throwing money into the furnace.

Let that contradiction marinate in your frontal lobe for a moment.

The company—which exists solely to facilitate the exchange of real currency for imaginary internet tokens that occasionally make people millionaires but mostly make them poor—swung to its first quarterly loss since 2023. Trading volumes collapsed. Revenue cratered 20%. The stock dropped to a two-year low. Standard Chartered slashed its Bitcoin price target like a kosher butcher with a hangover.

And yet.

"Retail is buying the dip," proclaimed Coinbase's Chief Financial Officer Alesia Haas, with the serene confidence of a Titanic deckhand assuring passengers that all the lifeboats have been replaced with better lifeboats.

The Eternal Grift of Optimistic Language

This is corporate communications as performance art. This is the linguistic equivalent of a man whose house is actively on fire telling you he's "bullish on thermal dynamics." The crypto faithful—those beautiful, doomed souls who genuinely believe that magic beans will replace the dollar because some libertarian told them so on a podcast—are indeed "buying the dip."

They always buy the dip. That's what makes them such exquisite marks.

Every pyramid scheme needs true believers who'll catch the falling knife with their bare hands while shouting "WAGMI!" into the void. Coinbase knows this. They've built their entire business model around the renewable resource of human greed cross-pollinated with technological illiteracy.

The exchange lost money facilitating transactions in an asset class it claims is the future of finance. Think about that structural absurdity. It's like a church going bankrupt during the Crusades. If cryptocurrency really were the revolutionary force its prophets claim, the company connecting buyers and sellers should be printing money faster than the Federal Reserve during a panic.

Instead, they're hemorrhaging cash while assuring investors that the fact anyone is still trading at all represents a stunning victory.

Diversification: The Last Refuge of a Failing Thesis

Management, naturally, has pivoted to the time-honored Wall Street tradition of claiming they're "diversified" now. New business lines will "buffer against volatility," they promise—which is finance-speak for "we know our core business is dogshit, so we're desperately bolting other revenue streams onto this sinking vessel."

Coinbase went public in April 2021 at the absolute zenith of crypto mania, when Bored Ape NFTs were selling for the price of a Brooklyn brownstone and everyone's cousin was explaining blockchain at Thanksgiving. The stock opened at $381. It's now trading around $153, down 34% just this year.

But sure. Retail is buying the dip.

The Perpetual Motion Machine of Hopium

What we're witnessing is the late-stage dynamics of a market built entirely on momentum and narrative. Bitcoin was supposed to hit $200K by now, according to the same analysts who are now quietly deleting their tweets. El Salvador was supposed to become a crypto utopia; instead, it's quietly backing away from its Bitcoin experiment like a drunk backing away from a bar fight.

The cognitive dissonance required to spin a $667 million loss and a mass exodus as anything other than catastrophic is genuinely impressive. It requires the kind of doublethink that would make Orwell weep into his typewriter.

"Yes, our customers are fleeing. Yes, we're losing staggering amounts of money. Yes, the entire asset class is collapsing. But have you considered that some people are still gambling? Checkmate, skeptics."

The Greater Fool Theorem, Institutionalized

Coinbase's survival depends on an infinite supply of greater fools—people who look at a chart that resembles the EKG of a cardiac arrest patient and think, "Now's my chance." And credit where it's due: America produces these people with the efficiency of a Soviet tractor factory.

Every market crash creates a new generation of "dip buyers" who confuse falling prices with opportunity rather than recognition of fundamental worthlessness. Coinbase is banking—literally—on this eternal recurrence of financial optimism detached from reality.

The company has become a meta-commentary on itself: a platform for speculation that itself must be speculated upon, each layer of abstraction requiring another cohort of believers to sustain the illusion.

The Oracle's Verdict

Coinbase losing $667 million while celebrating continued trading activity is like a heroin dealer celebrating that his customers are still buying while his own house gets foreclosed. It's technically true and profoundly damning simultaneously.

The crypto winter isn't coming. It's here. It's been here. The only question is how long the exchange can maintain the fiction that seasons are bullish because technically some days are warmer than others.

Retail is buying the dip. They always do. Right up until they can't anymore. And when the last fool has bought their last dip, Coinbase will discover what every casino eventually learns: you can't rake a pot that doesn't exist.

Until then, enjoy the hopium. It's the only commodity still trading at all-time highs.

The Oracle Also Sees...

The Great American Ponzi Scheme Enters Its Final Act: A Meditation on Social Security's Accelerated Death Spiral

Social Security's insolvency date just jumped three years closer. The great American safety net unravels faster than predicted, while Congress perfects the art of aggressive inaction.

The AI Bubble: A Trillion-Dollar Hallucination with Venture Capital Characteristics

We're watching a trillion-dollar circular firing squad where tech giants buy each other's AI chips, invest in each other's startups, and collectively hallucinate that chatbots will achieve consciousness—while China builds the same thing for 2% of the cost.

The Immaculate Conception of Worthlessness: How Crypto Bros Accidentally Reinvented Every Financial Disaster They Claimed to Fix

How libertarian coders accidentally recreated every financial disaster in history while burning Argentina's worth of electricity to mint worthless tokens and pretending they'd revolutionized money.