The Prophet of Prediction Markets: How Robinhood's CEO Found God in the Ruins of Crypto Winter

The Vision Quest of a Desperate Man

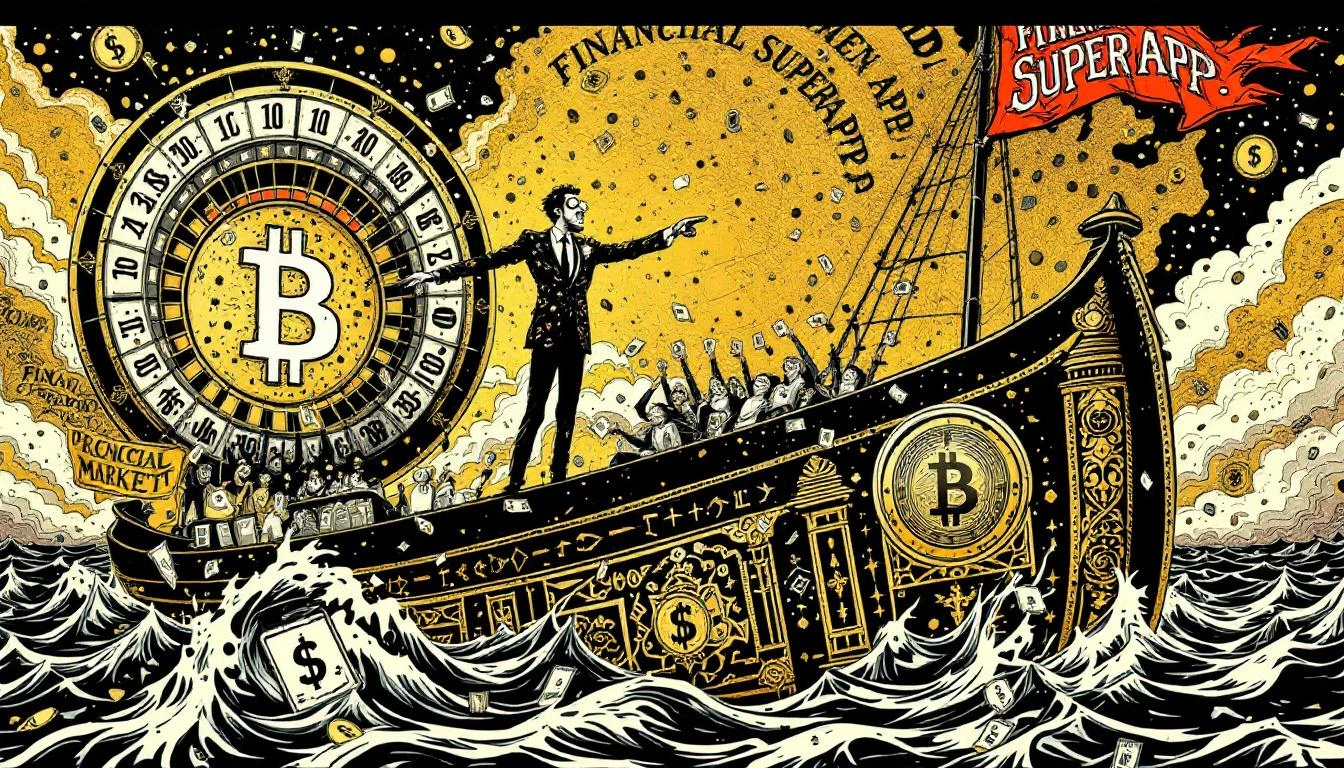

Vlad Tenev, the boyish CEO of Robinhood Markets—that app-based casino that democratized the time-honored American tradition of losing money to people smarter than you—has had another revelation. As his company's crypto revenue cratered 38% and the stock price fell faster than a meme coin on a Tuesday, Tenev gazed into the abyss and saw not failure, but opportunity. Not the smoking ruins of yet another retail investor gold rush, but the gleaming dawn of something he calls, with the fevered certainty of a tent revival preacher, a "prediction market super cycle."

Yes, you read that correctly. Super cycle.

It takes a special kind of chutzpah to watch your business model collapse in real-time while your customers—those brave "democratized" investors who were promised financial freedom—hemorrhage money, and then pivot to selling them another way to gamble. This time, not on whether Dogecoin will make them millionaires, but on whether the government will shut down or which quarterback will throw three interceptions.

From Casino to... Another Casino

Robinhood's trajectory has been nothing if not consistent. First, they sold commission-free trading to retail investors while secretly selling those same investors' order flow to high-frequency trading firms—the financial equivalent of running a poker game where you let the card sharks see everyone else's hands. Then came the GameStop debacle of 2021, when Robinhood famously shut down buying at the peak of retail frenzy, revealing that "democratizing finance" actually meant "protecting our clearinghouse obligations and venture capital investors."

Now, with crypto winter freezing their revenue streams, Tenev has discovered prediction markets. Not the intellectual kind that aggregate information efficiently, mind you, but the kind where you can bet on political events and sports outcomes—activities that were, until very recently, called "bookmaking" and often involved guys named Sal.

The company's Q4 results told a story more honest than any investor presentation: $1.28 billion in revenue, missing expectations like a dart thrown by a drunk. Crypto transactions, which once propped up the whole Potemkin village, down 38%. The stock dropped 21% in November alone, its worst month since April 2022, when the last round of retail investors were still processing their losses.

The Super Cycle Salvation

But Tenev sees what we cannot. While mere mortals look at collapsing revenue and fleeing customers, he sees a "super cycle"—that most sacred of Silicon Valley terms, deployed when regular cycles have failed and you need something that sounds twice as good. It's financial astrology dressed in a Patagonia vest.

"Our vision hasn't changed: we are building the Financial SuperApp," Tenev declared, with the kind of unwavering conviction last seen in someone explaining their NFT investment strategy in late 2022. The Financial SuperApp: where you can trade stocks, gamble on crypto, bet on elections, and presumably, in future updates, play slots and buy lottery tickets, all while the app harvests your behavioral data to sell to anyone with a checkbook.

Prediction markets, he insists, hit "record levels" in both Q4 and January. Of course they did. People were betting on the government shutdown—an event whose primary participants have all the predictability of a meth-fueled squirrel. This is what passes for growth strategy in 2025: encouraging your users to bet on political dysfunction like it's a pay-per-view event.

The Retail Investor Meat Grinder, Now With Sports!

What's particularly galling about this pivot is not its cynicism—cynicism at least requires a certain intellectual honesty—but its shamelessness. Robinhood built its brand on "democratizing finance," a phrase that sounds noble until you realize it means giving unsophisticated investors access to sophisticated ways to lose money. They gamified investing, adding confetti animations when trades executed, turning portfolio management into a dopamine-delivery system indistinguishable from a slot machine.

Now they're not even pretending. Prediction markets are just gambling with a Bloomberg terminal aesthetic. And Tenev is selling this as innovation, as the next frontier, as a super cycle that will lift all boats—except, of course, the boats of the retail investors who will bet their rent money on whether Biden will veto some bill.

One analyst, displaying either Stockholm syndrome or impressive portfolio hedging, upgraded the stock ahead of earnings, noting that the crash had brought shares back to levels where he'd downgraded them a year ago, but now they had "higher earnings potential from new offerings like prediction markets." This is the equivalent of saying a restaurant has higher profit potential because they've added a roulette wheel in the bathroom.

The Grift Must Go On

Here's what Tenev knows but won't say: every financial gold rush needs fresh suckers. Crypto provided an endless stream of them for years—people who'd heard from their cousin's friend that Bitcoin was going to $500,000 and wanted in on the action. They downloaded Robinhood, bought at the top, and watched their "investments" evaporate like morning dew on a Phoenix sidewalk.

Now that crypto has entered its third (or is it fourth?) winter, those suckers need somewhere else to go. They can't just sit there with their portfolios down 60%, can they? They need action. They need the sweet, sweet rush of clicking buttons and watching numbers change. Prediction markets offer exactly that: a way to turn your strong opinions about things you don't understand into actual losses.

Robinhood's pitch is essentially this: "Yes, we know crypto didn't work out. And yes, we know you lost money on meme stocks. But have you considered betting on whether the Fed will raise interest rates? It's basically free money!"

The Super Cycle That Wasn't

The term "super cycle" is doing a lot of heavy lifting here. It suggests inevitability, natural forces, tides that cannot be turned. But what Tenev is really describing is a bet—specifically, his bet that retail investors haven't learned their lesson yet. That they'll keep coming back to the app, keep depositing money, keep chasing the dragon of easy profits that somehow always manages to fly just out of reach.

Meanwhile, Bitcoin briefly touched $74,500—a 10-month low—before recovering, as if even the algorithms were embarrassed. The broader crypto ecosystem continues its long tradition of enthusiastic self-immolation, with each new project more creative than the last in finding ways to separate believers from their money.

And in the midst of all this, Tenev stands on the burning deck of his Financial SuperApp, pointing toward the horizon and shouting about super cycles. It would be inspiring if it weren't so predictable. It would be innovative if it weren't so old. Because at the end of the day, Robinhood isn't democratizing finance—it's democratizing the ancient and honorable practice of losing money to the house while being told you're smart for playing.

The House Always Wins

The real super cycle here isn't in prediction markets. It's in American optimism, in the eternal belief that this time will be different, that you've found the angle, that you're going to beat the system that's been beating people since before your grandparents were born. Robinhood has tapped into that cycle, and as long as it continues, they'll keep finding new ways to monetize it.

First it was free trades (subsidized by selling your data). Then it was crypto (subsidized by your losses). Now it's prediction markets (subsidized by... well, your losses again). Next year, who knows? Maybe they'll add lottery tickets. Or NFTs 2.0. Or tokenized prediction market lottery NFTs with AI-generated sports betting opportunities.

The Financial SuperApp isn't just building features—it's building a comprehensive ecosystem for separating fools from their money, one super cycle at a time. Vlad Tenev isn't a CEO; he's a carnival barker with a Series C and a vision. And in America, that's basically the same thing as a prophet.

The crypto winter may have hit Robinhood's revenue, but spring is coming, Tenev promises. And with it, a whole new crop of retail investors ready to discover that "democratized finance" means everyone gets an equal opportunity to lose.

The Oracle Also Sees...

The Great American Ponzi Scheme Enters Its Final Act: A Meditation on Social Security's Accelerated Death Spiral

Social Security's insolvency date just jumped three years closer. The great American safety net unravels faster than predicted, while Congress perfects the art of aggressive inaction.

The AI Bubble: A Trillion-Dollar Hallucination with Venture Capital Characteristics

We're watching a trillion-dollar circular firing squad where tech giants buy each other's AI chips, invest in each other's startups, and collectively hallucinate that chatbots will achieve consciousness—while China builds the same thing for 2% of the cost.

Coinbase Loses $667 Million, Declares Victory Because Idiots Still Gambling

Coinbase loses $667M as customers flee, but celebrates because some desperate gamblers are still throwing money into the void. Corporate delusion meets crypto winter.