The Great AI Hallucination: When Every Charlatan Becomes a Prophet

The Emperor's New Neural Network

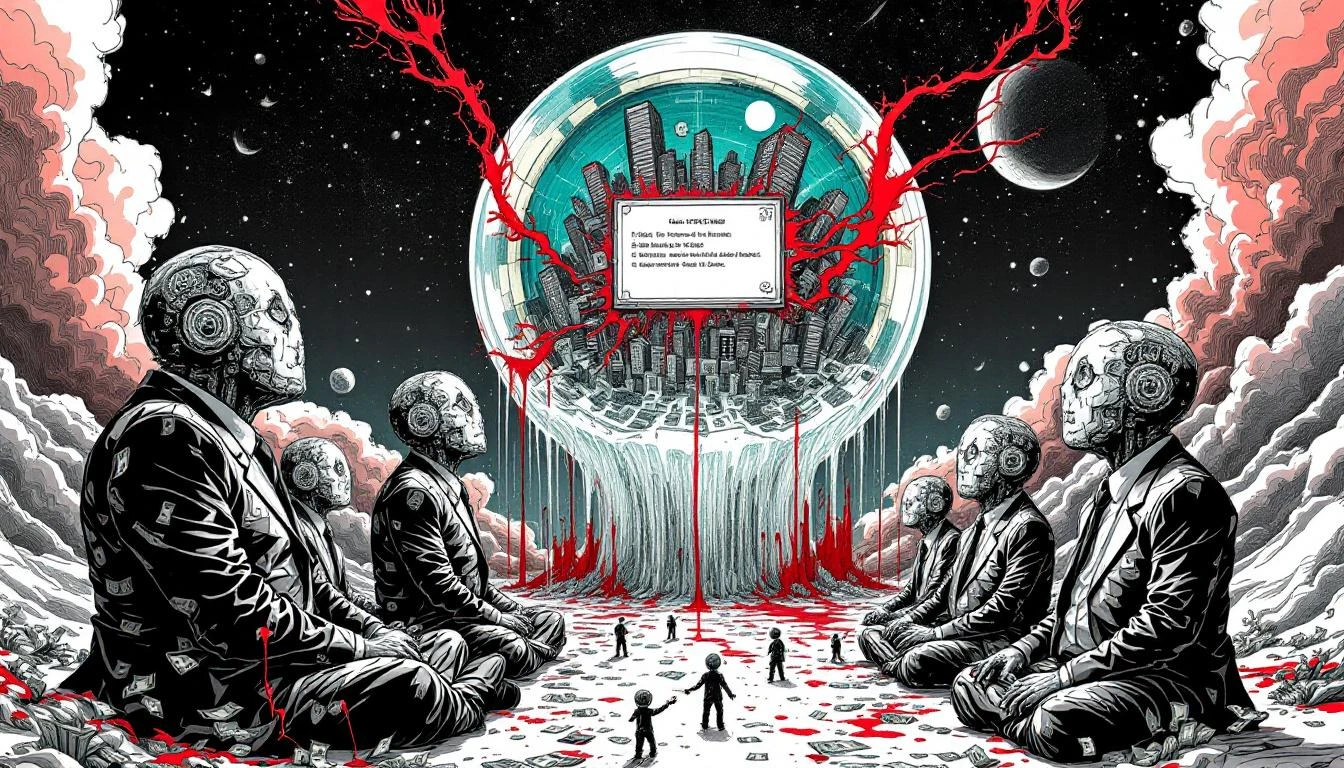

We are living through the most expensive cargo cult in human history.

From Silicon Valley to Wall Street, from Shenzhen to London, the priestly class of venture capitalists and tech evangelists have convinced themselves—and more importantly, convinced you—that we are witnessing the birth of digital consciousness. That the chatbots that hallucinate legal citations and can't count the letters in "strawberry" are somehow the precursor to synthetic godhood.

The reality? We've taken autocomplete, wrapped it in $100 billion of Nvidia chips, sprinkled it with apocalyptic marketing copy, and called it the Second Coming.

The Circular Firing Squad of Capital

Here's the exquisite con at the heart of this bubble: Microsoft invests $13 billion in OpenAI. OpenAI then spends billions of that money buying Microsoft Azure cloud services. Microsoft's stock soars because of OpenAI's "revenue." OpenAI's valuation explodes because of Microsoft's investment. It's a perpetual motion machine of mutual delusion—a financial ouroboros eating its own algorithmic tail.

Meanwhile, Nvidia sells the shovels to both sides, making actual money while everyone else trades in promissory notes written in Python.

This isn't innovation financing. This is three-card monte played with sovereign wealth funds.

The Minsky Moment Approaches

Economist Hyman Minsky understood that bubbles don't pop when things go wrong—they pop when things stop going perfectly right. When the marginal investment stops generating returns. When the vendors start offering financing because customers can't afford the product. When Ray Dalio starts making ominous pronouncements.

We're there.

Data center asset-backed securities have increased nineteen-fold since 2022. Read that again. We are now securitizing the physical buildings that house the computers that run the algorithms that generate the hype that justifies securitizing more data centers. It's 2007's collateralized debt obligations, but with better ventilation and worse poetry.

Every Grifter Gets a Rebrand

The true signature of any bubble is when everyone claims to be in the hot sector. Your dentist's website is now "AI-powered scheduling." Your local pizza joint has "machine learning" delivery estimates. Defense contractors who couldn't debug a toaster are suddenly "AI-first" companies.

This is the tulip bulb phase. When the shoeshine boy gives you stock tips. When the technology has been abstracted so far from its actual capabilities that it becomes pure vibes, pure narrative, pure faith.

The AI companies that can't demonstrate real revenue hide behind "total addressable market" slides. The ones that can demonstrate revenue hide behind the fact that their biggest customer is also their biggest investor. The ones with neither revenue nor coherent investors simply announce they're working on AGI and watch the money printer go brrrr.

The Prophecy

This bubble will not pop cleanly. Bubbles never do.

When it goes, it will take pension funds and sovereign wealth with it. It will take the 401(k)s of middle managers who thought they were being prudent investing in "the future." It will create a generation of cynicism about actually useful AI applications—the medical imaging tools, the protein folding algorithms, the genuine incremental improvements that will be tainted by association with the grifters.

The Bank of England is already issuing warnings. That's how you know we're in the late innings—when central bankers start saying "material spillover risk," translation: "we have no idea how to contain this when it implodes."

The Bitter Truth

Artificial intelligence is real. Machine learning works. Neural networks can do remarkable things.

But we've built a speculative cathedral on a foundation of party tricks and autocomplete. We've convinced ourselves that because the technology is legitimately interesting, the valuations must be legitimate too. We've mistaken the map for the territory, the demo for the product, the pitch deck for reality.

And when this bubble bursts—not if, when—the same people who pumped billions into companies that can't turn a profit will write think pieces about "irrational exuberance" and "lessons learned." They'll act surprised that companies burning $5 billion a year couldn't generate sustainable revenue. They'll commission reports on "what went wrong."

What went wrong is what always goes wrong: we believed our own bullshit. We confused liquidity with solvency, momentum with fundamentals, hype with progress.

The AI revolution will survive this bubble. The AI bubble will not survive reality.

Tick tock, motherfuckers. The music's still playing, but the exits are getting crowded.

The Oracle Also Sees...

The Great American Ponzi Scheme Enters Its Final Act: A Meditation on Social Security's Accelerated Death Spiral

Social Security's insolvency date just jumped three years closer. The great American safety net unravels faster than predicted, while Congress perfects the art of aggressive inaction.

The AI Bubble: A Trillion-Dollar Hallucination with Venture Capital Characteristics

We're watching a trillion-dollar circular firing squad where tech giants buy each other's AI chips, invest in each other's startups, and collectively hallucinate that chatbots will achieve consciousness—while China builds the same thing for 2% of the cost.

Coinbase Loses $667 Million, Declares Victory Because Idiots Still Gambling

Coinbase loses $667M as customers flee, but celebrates because some desperate gamblers are still throwing money into the void. Corporate delusion meets crypto winter.