Trump Accounts: Teaching Children Financial Literacy Through Branded Grift

The American Dream, Now Available in Commemorative Form

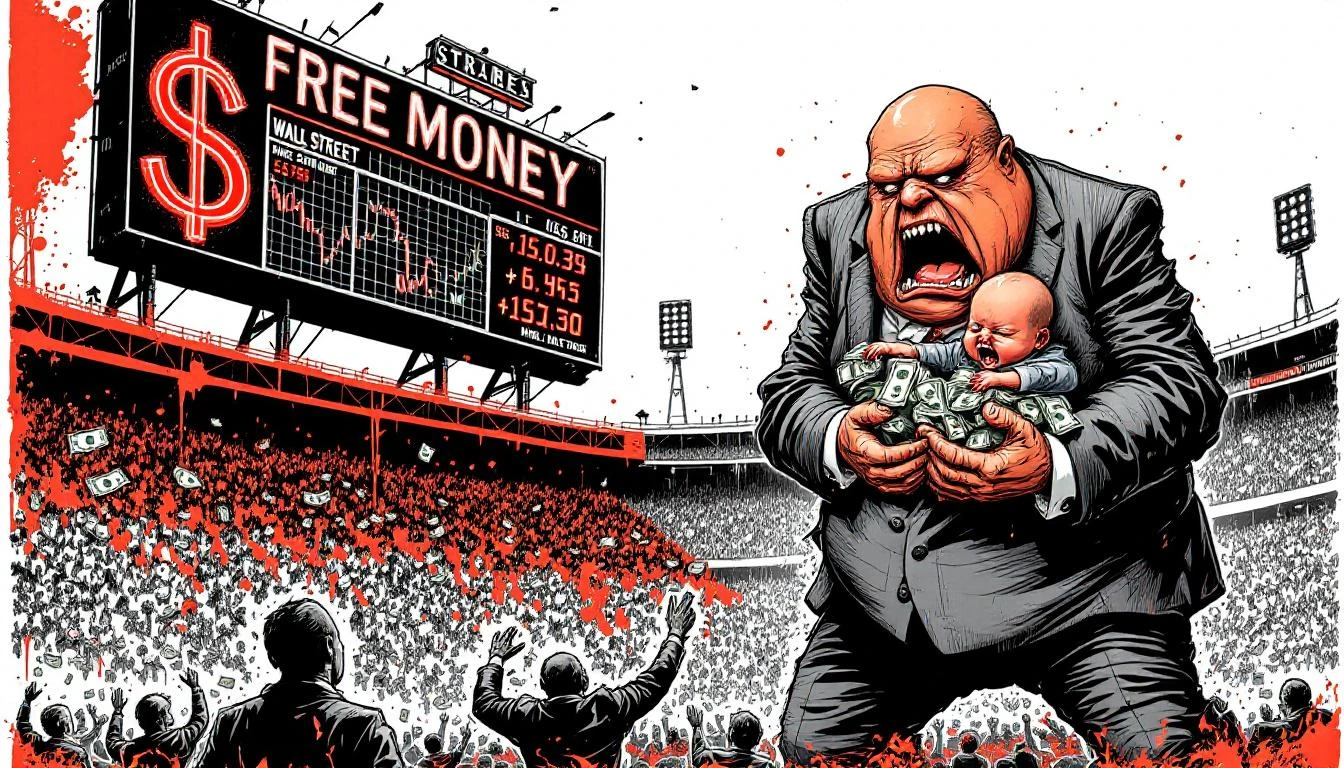

Somewhere between the Puppy Bowl and a beer commercial featuring CGI frogs, America received its latest economic salvation: the Trump Account. A tax-advantaged investment vehicle for children, named after a sitting president, advertised during the Super Bowl by a nonprofit founded by Republican strategists, funded partially by government seed money, and branded with all the subtlety of a gold-plated toilet seat.

We have finally achieved peak American capitalism: the commodification of childhood futures as political merchandising.

The Mechanics of Cynicism

Let's parse this masterwork of 21st-century financial engineering. The so-called "530A" accounts—and yes, they actually rebranded a tax code designation into a president's surname like it's a line of steaks or a failed university—will provide eligible American children born between 2025 and 2028 with a princely $1,000 government deposit. One thousand dollars. Invested in stock market index funds. For children.

Never mind that $1,000 in 2025 dollars, even with optimistic market returns, will accumulate to roughly enough money in eighteen years to cover approximately one semester of textbooks or perhaps three months of health insurance premiums. Never mind that this "jumpstarting the American Dream" happens to coincide with the systematic dismantling of actual social safety nets, public education funding, and affordable healthcare. Never mind that we're teaching children their financial security depends on the whims of Wall Street rather than, say, a functioning social contract.

The beauty of the scam isn't in the economics. It's in the branding.

Bipartisan Grift: The Most American Value

The promotional materials proudly trumpet "bipartisan support," as if both parties enthusiastically endorsing something makes it virtuous rather than doubly suspicious. When Democrats and Republicans agree on financial policy, reach for your wallet—they've found a new way to funnel public money toward private markets while calling it "opportunity."

Invest America, the nonprofit pushing this scheme, was founded by Matt Lira, a Republican strategist. Not an economist. Not a child welfare advocate. A strategist. Because nothing says "we care about your children's future" like a political operative selling you investment vehicles during commercial breaks in a football game where grown men give each other brain damage for shareholder profit.

The Trump administration rolled this out alongside billionaires and celebrities, predicting "significant growth and a transformative impact." Transformative indeed. We're transforming newborns into market participants before they can control their bowels. We're transforming childhood into an investment thesis. We're transforming the social safety net into a fucking index fund.

The Super Bowl: Where Dreams Go to Be Monetized

That this was advertised during the Super Bowl—America's annual festival of consumption, nationalism, and crypto scam commercials—is fitting. The Super Bowl is where FTX bought ads before collapsing into fraud. Where dot-com companies burned millions on commercials months before bankruptcy. Where the American id goes to be flattered and pickpocketed simultaneously.

The ad itself reportedly speaks "directly to parents about 'free money.'" Free money. From the government. Deposited into stock market accounts that will be managed by... whom exactly? Overseen by which regulatory framework? Subject to what fees? Protected how when the next market crash comes?

Details remain scarce, says The Guardian. Of course they do. Details are for nerds and communists. This is America. We run on vibes and brand recognition.

What We're Actually Teaching Children

Here's the real curriculum of Trump Accounts:

Lesson One: Your future security depends not on collective investment in education, healthcare, and infrastructure, but on whether the S&P 500 goes up.

Lesson Two: Political leaders' names belong on financial products. This is normal. Like Putin Bonds or Xi Certificates of Deposit.

Lesson Three: "Free money" from the government that you can't access for eighteen years and that depends on market performance is functionally identical to actual social investment. Don't think too hard about it.

Lesson Four: Every citizen is a portfolio. Every child is a potential wealth accumulation vehicle. Human dignity is measured in basis points.

What we're not teaching: that a society that cared about children's futures would provide free healthcare, subsidized childcare, fully-funded public education, clean air and water, and a habitable planet. But that's socialism or whatever.

The Wikipedia Entry Already Exists

The most damning detail? There's already a Wikipedia entry for "Trump account." We've mainstreamed this so thoroughly, so quickly, that the internet's collective encyclopedia has documented it as historical fact before the first account has matured.

Future historians—assuming any survive the climate collapse these children's "investment accounts" will do nothing to prevent—will read this entry and conclude we were either magnificently stupid or exquisitely evil. Perhaps both.

The Oracle's Verdict

Trump Accounts represent everything wrong with American economic policy condensed into a single, branded product: the privatization of social responsibility, the financialization of childhood, the branding of government programs like consumer goods, and the bipartisan consensus that markets solve all problems including the ones markets create.

We are giving children $1,000 and calling it a future. We are naming government programs after living politicians and calling it normal. We are advertising public policy during football games and calling it civic engagement.

Meanwhile, child poverty rates climb, school lunch debt accumulates, pediatric cancer treatment bankrupts families, and the planet literally burns. But don't worry, kids—you've got a Trump Account. That $1,000 might be worth $3,000 by the time you're eighteen. Almost enough for a down payment on the Hellscape we're leaving you.

The American Dream isn't dead. It's just been rebranded as a tax-advantaged investment vehicle with a presidential endorsement, available for a limited time, subject to market conditions, past performance not indicative of future results.

Invest early. Invest often. And remember: your children's futures are brought to you by the same people who brought you everything else that's broken.

Disclosures: The Oracle maintains no Trump Accounts, owns no index funds named after politicians, and recommends guillotines as a more reliable long-term investment strategy.

The Oracle Also Sees...

The Great American Ponzi Scheme Enters Its Final Act: A Meditation on Social Security's Accelerated Death Spiral

Social Security's insolvency date just jumped three years closer. The great American safety net unravels faster than predicted, while Congress perfects the art of aggressive inaction.

The AI Bubble: A Trillion-Dollar Hallucination with Venture Capital Characteristics

We're watching a trillion-dollar circular firing squad where tech giants buy each other's AI chips, invest in each other's startups, and collectively hallucinate that chatbots will achieve consciousness—while China builds the same thing for 2% of the cost.

Coinbase Loses $667 Million, Declares Victory Because Idiots Still Gambling

Coinbase loses $667M as customers flee, but celebrates because some desperate gamblers are still throwing money into the void. Corporate delusion meets crypto winter.